Starting a new business is always a challenge. And it can be even more uphill when doing it in a country as a foreigner. But don't be discouraged. In this article, we will tell you how to set up a company in Chile as a foreigner, even if you are not physically in Chile.

You will see that although there are several steps to follow, it is not as complex as you may have imagined.In Chile, anyone can set up a company. Whether natural persons or legal entities, nationals or foreigners. Regardless of nationality, and visa or residency status. Here we'll tell you how.

Types of business incorporations in Chile

First, it is essential to understand that in Chile there are different types of companies. You must define which one best suits your needs and interests. You should always do this before starting the process of setting up your company. For this, we recommend that you consult an expert business law attorney who can recommend the appropriate legal structure for your business. It is important to keep in mind that the legal structure of the business will determine which regulations the company will observe. In addition, it will define other aspects such as what its form of administration will be, who will make the decisions and how it will be taxed.

Initially, we can distinguish two ways of undertaking any commercial endeavor

- As a Natural Person, (a normal physical person, “you” or “me”): the natural person develops commercial activities in his or her own name, assuming the rights and obligations of the activity carried out. The responsibility of the individual entrepreneur is unlimited, being able to respond with his or her personal assets for the obligations or debts contracted as a result of his activity.

- As a Legal person, a legal entity: it is an independent legal entity, with its own assets and distinct from the individual members that form it. It has its own RUT (Chilean Tax ID Number) and is subject to rights and obligations that are recognized by the State.

Note: You may be interested in our article detailing everything you need to know about how to set up a company in Chile.

Types of companies in Chile

Chilean law offers different types of companies. These different alternatives developed over time; therefore, some may be more adequate for current business practices than others. Each one may be more adequate to each particular business purposes. Next we will mention its main characteristics:

Commercial Companies:

Limited Liability Company (“Sociedad de Responsabilidad Limitada” or “Ltda.”):

It is a company of at least two persons in which the system of administration and representation can be freely established. It must be a minimum of two people and up to fifty, and they can be nationals or foreigners, natural or legal persons. The partners are liable only up to the amount of the contribution they made. Their participation and rights are represented in the membership fee. Unless a special administration method is decided by the partners, all decisions must be agreed by all partners. It has been the traditional entity type used by professional service companies. Lately, its popularity has decreased in favor of the Joint Stock Company (“Sociedad por Acciones”).

Commercial Collective Societies:

They are formed for businesses classified as acts of commerce according to the Commercial Code. The administration of this company corresponds by right to each and every one of the managing partners, who can exercise it by themselves or through delegates. The partners can designate an administrator in the social deed or in a later act. Those who are general partners present in the social deed will be jointly and severally liable for all the obligations legally contracted by the company. The partners may not derogate from joint and several liability in partnerships.

Commercial limited partnerships:

There are two types of partners: managing partners and limited partners. The former are those who have the faculty of administration and are jointly and severally liable for social obligations. Their names appear in the company name. The second, meanwhile, are the capitalist partners in terms of the social contribution and liabilities in relation to the administration of the company. The latter limit their liability to the amount of their contributions. There are two types of limited partnerships: the simple limited partnership and the limited by shares.

Corporation:

The corporation is a legal person, always of a commercial nature. It is made up of a common fund contributed by the shareholders, who are only liable for the amount of their contribution. There is the figure of the Shareholders' Meeting, who make the decisions of an organic nature, and on the other hand there is the Board of Directors, whose members are essentially revocable, that makes the management decisions of the company. There are Open Stock Companies, that is, their shares are traded on the Stock Exchange, and Closed Stock Companies that have shares that are not traded on the Stock Exchange.

Civil Legal Entities:

- Civil Collective Societies: In civil partnerships, the partners respond even with their personal assets, the share of the insolvent burdens the other partners and the agreements are generally taken unanimously.

- Civil limited partnerships: In these companies, the managing partners or administrators respond even for their personal assets, and the limited partners for their contribution. Both the constitution and the dissolution of these companies is consensual.

Sole Proprietorships:

- Individual Limited Liability Company (EIRL): It is formed only by a single natural person. The EIRLs have their own assets and are different from those of the owner. Thus, the owner of the individual company responds only with the contributions made or that he has promised to incorporate. For its part, the company responds with all its assets for its obligations generated in the exercise of its activity.

5 steps to set up a company un Chile as a foreigner

It is important to remember that there are no restrictions by nationality to set up a company in Chile. You just need to have the desire and the confidence to launch.

Below we list in five steps the process to set up a company in Chile as a foreigner.

1. Obtaining a provisional RUT – RUT for a Foreign Investor

All foreign investors, whether natural or legal persons, including those not domiciled or resident in Chile, must obtain a tax identification number (RUT) from the (SII) before materializing their investment. All foreign investors who obtain a RUT must designate a legal representative to act on their behalf before the tax authorities. This legal representative may be Chilean or of another nationality, but must be domiciled or resident in Chile.

Requirements to carry out this procedure

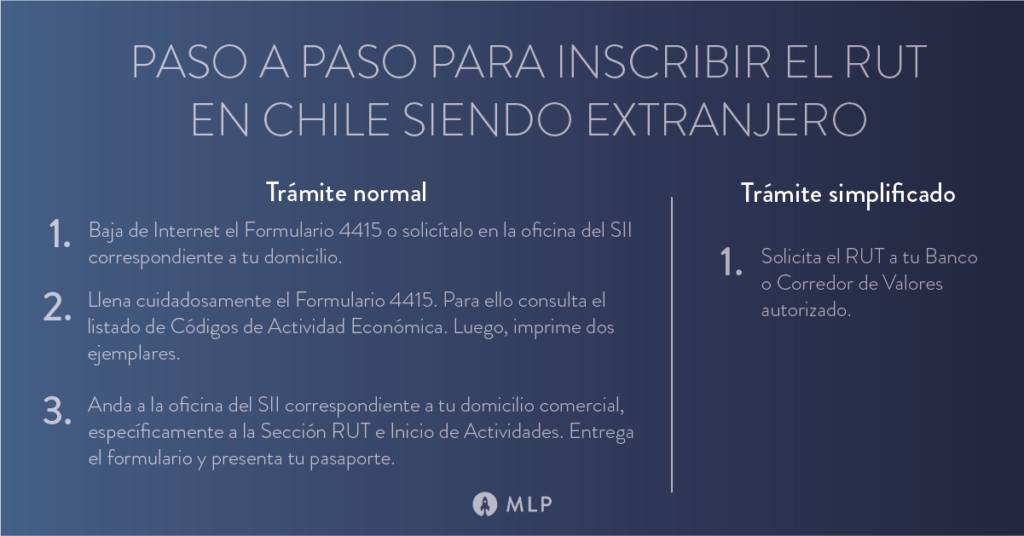

Normal procedure:

This procedure can be carried out personally by the foreign investor or through the legal representative domiciled or resident in Chile. In the first case, the foreign investor must go to the SII offices with the legal representative, carrying his passport or identity card, and fill out Form F-4415.

If the procedure is carried out by the legal representative, the foreign investor must grant him or her sufficient power to act before the SII and, in particular, to legalize, complete and sign the Form F-4415, as well as to receive notifications and attend meetings with the tax authorities on behalf of the investor. This power of attorney can be granted before a notary public in Chile or in another country but, in the latter case, it must be legalized in accordance with the Hague Apostille Convention or by the Chilean consul in that country and the Ministry of Foreign Affairs of Chile.

Simplified Procedure:

Este procedimiento se lleva a cabo directamente por los bancos autorizados y corredores de bolsa que pueden obtener un RUT para los clientes que invierten en Chile para obtener ingresos por la compra y venta de acciones en sociedades anónimas abiertas, sean negociadas regularmente o no, y de instrumentos de renta fija, la intermediación financiera, participaciones en fondos de inversión o determinados contratos.

In addition, they must comply with the restrictions of this simplified mechanism, such as type of investment and origin of funds (see details at Ex. Res. N° 5412 of 2000, N° 20 of 2001 and N° 47 of 2004).

2. Incorporation of the company

For this step, it is important that you have a clear idea of the corporate figure that you require for your company. You can contact our expert team of My Local Partner for advise.

3. Registration in the Trade Registry

Once incorporated, you have 60 days to register the extract of the deed of incorporation of the new company in the Registrar of Commerce of the Conservator. The registration of the company is carried out directly at the Registrar of Real Estate which corresponds to the domicile established by the company in its deed.

The process takes three to seven business days. Later you must withdraw the "protocolization" of the company (pages, registration number and year).

4. Official Gazette Publication

You must ask the notary to send the virtual extract of the company's constitution to the Official Gazette. The value of the publication is 1 UTM for each extract, unless the share capital is less than 5,000 UF. In that case the publication will be exempt from payment.

If the capital is not mentioned in the extract, it must be accredited with a certificate from the Real Estate Registrar that must be attached when you request publication. This takes approximately two business days.

5. Obtaining the RUT of the company and beginning of activities at the Internal Revenue Service

These procedures are carried out before the SII, both of which can be carried out remotely through the SII's online platform. The generation of the RUT of the company must be carried out once the company is established, assigning a RUT to the legal entity, identifying it as a taxpayer. The purpose of the start of activities is to notify the SII that the new company will start commercial activities, also informing the tax regime under which the company will be taxed.

It is important to remember that there must be an authorized address for the development of business activities, which must be reported in this procedure at the SII, being established as the tax address.

Are there additional costs in setting up a company in Chile as a foreigner?

With all the information in this article, you just need to look at the latest administrative details. Although it is possible to set up a company in Chile as a foreigner, you should consider certain additional amounts regarding the constitution of your new company in Chile.

You have the option to set up your company in a digital platform called your company in one day. This alternative is almost free. However, it is likely that taking this option you have many doubts. Our recommendation is that you follow the traditional path through a public deed receiving the advice of an expert. Although it takes a little more time, for future procedures or corporate modifications of the company, it turns out to be more practical, friendly and less rigid than the system your company in one day.

If you are a foreigner and choose to incorporate your company in Chile through the notarial system, you must take into account the following:

- Drafting of the deed of the company and the corresponding notarial costs.

- Publication in the Official Gazette (free for companies with up to 5,000 UF of Capital).

- The registration of the extract in the Registry of Commerce of the Real Estate Registrar.

- The additional amounts that you must consider regarding your foreign status refer to the processing of the RUT as a foreign investor.

- You should consider the costs of legal advice to ensure that expert lawyers supervise your process.

- One last cost to consider is the tax domicile, as mentioned above.

Why contract the services of My Local Partner?

My Local Partner is a business consultancy that has a team of prestigious professionals. My Local Partner is made up of lawyers and accountants who have global business experience. This is why they know the needs, concerns and interests of their clients, both Chilean and foreign.

If you need expert advice on legal, tax, labor law, entrepreneurship, accounting and BPO issues, do not hesitate to contact us on our website.

Recent Comments